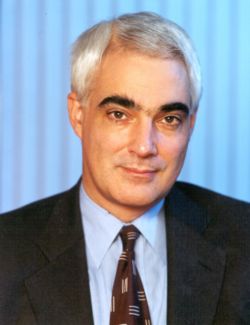

Alistair Darling

| Supplementary material: (i) links to contemporary reports ; (ii) notes on fiscal developments. |

Alistair Darling (born 28th November 1953) was the British finance minister, the Chancellor of the Exchequer, from June 2007 until May 2010, and prior to that served from 1997 in various senior ministerial posts. He is one of five Members of Parliament (MPs) for the city of Edinburgh in Scotland, a seat he has held since 1987.

Early life

Parliamentary career

Alistair Darling came to government with the election of the Labour Party and Tony Blair in 1997, following his earlier career as a solicitor, service as local councillor, election as MP for Edinburgh South West, and successive roles as Opposition spokesman on various issues. He was first appointed Chief Secretary to the Treasury (May 1997 - July 1998), deputising Gordon Brown as Chancellor - an experience which would make him the obvious choice for the finance portfolio in Brown's first Cabinet (the UK executive branch of government).

Darling was appointed Secretary of State for Social Security in July 1998, a post he held until the election of the second Labour government in June 2001. His next position was Secretary of State for the Department of Work and Pensions, until May 2002. He was then given two positions, as the Secretaries of State for Transport and Scotland, which he occupied until May 2006. His final job in Tony Blair's Cabinet was as Secretary of State for the Department of Trade and Industry.

Chancellor of the Exchequer

- The economic developments during Alistair darling's chancellorship are described in the article on the Great Recession, and their effects upon the Government's finances are summarised in the addendum to this article

When Alastair Darling took over as Chancellor of the Exchequer in June 2007, some banks were beginning to suffer the effects of the subprime mortgage crisis, but the economy was continuing to grow at an above-trend rate. Later in that year, however, commodity price increases were beginning to affect growth, and the banking crisis was getting worse. In his November pre-budget report, Alistair Darling warned that a continuation of the banking crisis could reduce the rate of further growth[2]. By the middle of 2008, his fears were realised, and the economy was suffering from the effects of a major international financial crisis which he described in an interview as arguably the worst in 60 years"[3]. (That statement was attacked by the Shadow Chancellor as an admission of the Government's failings and a contradiction of reassuring statements by Gordon Brown[4]).

In the October 2008, there was a major intensification of the financial crisis, triggered by the previous month's collapse of the United States Lehman Brothers investment bank. Alistair Darling and Gordon Brown responded with a rescue package for British banks [5], and an international campaign[6][7] to persuade other governments to adopt similar measures in support their banks. During the following months, the British example was followed by other European countries [8] and similar measures were adopted by the United States. Those actions were followed by stabilisation of the financial system, but many British banks continued to suffer serious financial difficulties. A programme of additional support for the banks was adopted and by April 2009, five of the nine largest British banks had been taken partly or wholly into public ownership - in addition to the 2007 nationalisation of Northern Rock.

In November 2008, Alistair Darling announced a fiscal stimulus amounting to 1.5 per cent of GDP, including a temporary 2½ percentage points reduction in value-added tax and a bringing forward of £3 billion of capital investment[9]. His announcement had a mixed reception: it was called deceitful by the Shadow Chancellor[10] and "crass" by the German Finance Minister[11], but was subsequently described as successful by the International Monetary Fund[12]. There were responses to criticisms of the tax reduction by the Institute for Fiscal Studies [13] and the Centre for Economics and Business Research [14]

The growth of output resumed in the 4th quarter of 2009, and attention turned to the problem of reducing the, by then inflated budget deficit. Alistair Darling had inherited from Gordon Brown a deficit of 2.7 per cent of national income, which was above the OECD average, but lower than the deficit that Gordon Brown had inherited from his predecessor[15]. By the end of 2009 the deficit had grown to nearly 12 per cent, of which less than 2 per cent was the result of Alistair Darling's fiscal policy actions, and the remainder was due the recessionary operation of the economy's automatic stabilisers. The Institute for Fiscal Studies estimates the structural deficit - which is the portion of the deficit that is expected to persist after recessionary influences have ceased - to be about 6 per cent of national income.

Retirement

Following the 2010 election, Alistair Darling became the [[Official Opposition (UK)|opposition's Shadow Chancellor until October 2010, when he retired from the Shadow Cabinet.

References

- ↑ Office of Public Sector Information, UK.

- ↑ 2007 Pre-Budget Report and Comprehensive Spending Review statement to the House of Commons, delivered by the Rt Hon Alistair Darling MP, Chancellor of the Exchequer, 9 October 2007

- ↑ Guardian: 'Economy at 60-year low, says Darling. And it will get worse'. 30th August 2008.

- ↑ BBC News: 'Darling defends economy warning'. 30th August 2008.

- ↑ Rescue plan for UK banks unveiled, BBC News, 8 October 2008

- ↑ Paul Krugman: Gordon Does Good, October 12, 2008

- ↑ Andrew Rawnsley: The weekend Gordon Brown saved the banks from the abyss, The Guardian, 21 February 2010

- ↑ Lucia Quaglia: The ‘British Plan’ as a Pace-Setter: The Europeanization of Banking Rescue Plans in the EU?, Wiley Online Library, 20 October 2009

- ↑ Pre-Budget Report 2008, National Archives, 24 November 2008

- ↑ Osborne slams 'tax timebomb' plan, BBC News, 24 November 2008

- ↑ VAT cut is “crass Keynesianism”: The latest view from the German government, Financial Times, December 10, 2008

- ↑ United Kingdom – 2009 Article IV Consultation. Concluding Statement of the Mission, International Monetary Fund, May 20, 2009

- ↑ Thomas Crossley, Hamish Low, and Matthew Wakefield: The Economics of a Temporary VAT Cut, Institute for Fiscal Studies, January 2009

- ↑ Dan Milmo: Darling's VAT cut worked, says economics consultancy, guardian.co.uk, 12 April 2009

- ↑ Robert Chote, Carl Emmerson and Gemma Tetlow: Green Budget 2008, Institute for Fiscal Studies, March 2008