imported>Chunbum Park |

imported>John Stephenson |

| (205 intermediate revisions by 8 users not shown) |

| Line 1: |

Line 1: |

| In their 2010 report, the Economic Advisors to the President referred the recent economic downturn as the '''[[Great Recession]]''', suggesting a parallel with the Great Depression of the 1930s. Like the Great Depression - and unlike other recessions - it had a simultaneous impact on most of the world's economies. But in other respects it was unique. There had been no precedent for such extensive damage to the world's financial system, nor for the coordinated measures that were taken to avert what was feared to be its imminent collapse.

| | {{:{{FeaturedArticleTitle}}}} |

| | | <small> |

| Although, according to the generally accepted definition of the term, the recession ended in most countries when economic growth resumed during 2009, its damaging effects upon the major economies are expected to persist beyond 2011, and its ultimate cost may amount to as much as a whole year's ouput of every country in the world.

| | ==Footnotes== |

| | | {{reflist|2}} |

| The Great Recession has prompted a re-examination of beliefs concerning the functioning of markets comparable to that which followed the Great Depression.

| | </small> |

| | |

| =====Introduction===== | |

| Explanations of the causes of the recession and accounts of contemporary debates concerning policy responses are available in the articles on the subprime mortgage crisis, the crash of 2008 and the recession of 2009, together with timelines linked to contemporary reports.

| |

| | |

| =====Overview=====

| |

| During the 1980s there was a widespread re-appraisal of the regulations that had been introduced in response to the financial instability that developed during the Great Depression. A consensus had already emerged that many regulations were economically harmful, as a result of which programmes of deregulation had been adopted. The reappraisal concluded that the financial regulations of the 1930s had become unnecessary because recently-developed monetary policy could be used to counter any further signs of instability. Ongoing programmes of banking deregulation that had prevented investment banks from engaging in branch banking, insurance or mortgage lending were dropped, and reserve requirements were relaxed or removed.

| |

| | |

| After the mid-1980s came a twenty-year period that has been termed the great moderation, during which recessions had been less frequent and less severe than in previous periods, and during which there been a great deal of successful financial innovation.

| |

| | |

| In the United States, that period was characterised by massive capital inflows and the large-scale availability of credit to households, and by 2007 personal savings rates dropped to 2 per cent of disposable income from their previous average of 9 per cent and there was a house price boom that has since been categorised as a bubble.

| |

| The bursting of that bubble in 2007, and the downgrading by the credit rating agencies of large numbers of internationally-held financial assets created what came to be known as the subprime mortgage crisis, which led, in turn, to the financial crash of 2008 and the failure of several of the world's largest banks. The loss of investors' confidence caused by failure of the ''Lehman Brothers'' investment bank in September 2008, resulted in a credit crunch. The resulting fall in spending struck the major economies at a time when they were already suffering from the impact of a supply shock in which a surge in commodity prices was causing households to reduce their spending. Economic forecasters had been expecting a mild downturn: what actually happened was the global slump in ecomomic activity that has come to be known as the Great Recession.

| |

| | |

| Although the trigger that set the recession off had been the malfunction of a part of the United States housing market, it soon emerged that a more fundamental problem had been the fact that the financial innovations that had been richly rewarding traders in the world's financial markets, had also been threatening their collective survival. The crucial nature of that threat for the stability of the world economy arose from the fact that it had become dependent upon the services of a well-functioning international financial system.

| |

| ''[[Great Recession|.... (read more)]]''

| |

| {|align="center" cellpadding="5" style="background:lightgray; width:60%; border: 1px solid #aaa; margin:10px; font-size: 92%;" | |

| | Supplements to this article include an annotated[[Great Recession/Timelines|''' chronology ''']] of the main events of the recession; and accounts of the [[Great Recession/Addendum| '''regional impact''']] of the recession.

| |

| |}

| |

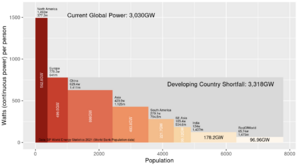

After decades of failure to slow the rising global consumption of coal, oil and gas,[1] many countries have proceeded as of 2024 to reconsider nuclear power in order to lower the demand for fossil fuels.[2] Wind and solar power alone, without large-scale storage for these intermittent sources, are unlikely to meet the world's needs for reliable energy.[3][4][5] See Figures 1 and 2 on the magnitude of the world energy challenge.

Nuclear power plants that use nuclear reactors to create electricity could provide the abundant, zero-carbon, dispatchable[6] energy needed for a low-carbon future, but not by simply building more of what we already have. New innovative designs for nuclear reactors are needed to avoid the problems of the past.

(CC) Image: Geoff Russell Fig.1 Electricity consumption may soon double, mostly from coal-fired power plants in the developing world.

[7] Issues Confronting the Nuclear Industry

New reactor designers have sought to address issues that have prevented the acceptance of nuclear power, including safety, waste management, weapons proliferation, and cost. This article will summarize the questions that have been raised and the criteria that have been established for evaluating these designs. Answers to these questions will be provided by the designers of these reactors in the articles on their designs. Further debate will be provided in the Discussion and the Debate Guide pages of those articles.

- ↑ Global Energy Growth by Our World In Data

- ↑ Public figures who have reconsidered their stance on nuclear power are listed on the External Links tab of this article.

- ↑ Pumped storage is currently the most economical way to store electricity, but it requires a large reservoir on a nearby hill or in an abandoned mine. Li-ion battery systems at $500 per KWh are not practical for utility-scale storage. See Energy Storage for a summary of other alternatives.

- ↑ Utilities that include wind and solar power in their grid must have non-intermittent generating capacity (typically fossil fuels) to handle maximum demand for several days. They can save on fuel, but the cost of the plant is the same with or without intermittent sources.

- ↑ Mark Jacobson believes that long-distance transmission lines can provide an alternative to costly storage. See the bibliography for more on this proposal and the critique by Christopher Clack.

- ↑ "Load following" is the term used by utilities, and is important when there is a lot of wind and solar on the grid. Some reactors are not able to do this.

- ↑ Fig.1.3 in Devanney "Why Nuclear Power has been a Flop"