U.S. Economic history

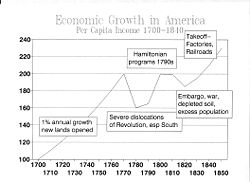

The Economic History of the United States has its roots in European settlements in the 16th, 17th, and 18th centuries. The American colonies progressed from marginally successful colonial economies to a small, independent farming economy, which in 1776 became the United States of America. In 230 years the United States grew to a huge, integrated, industrialized economy that makes up over a quarter of the world economy. The main causes were a large unified market, a supportive political-legal system, vast areas of highly productive farmlands, vast natural resources (especially timber, coal and oil), and an entrepreneurial spirit and commitment to investing in material and human capital. The economy has maintained high wages, attracting immigrants by the millions from all over the world.

Colonial era

Migrants were pulled to American by the hope of economic prosperity, in addition to religious goals in some cases. The Puritans of Massachusetts wanted to create a purified religion in New England. Other colonies, such as Virginia, were founded principally as business ventures. England's success at colonizing what would become the United States was due in large part to its use of charter companies. Charter companies were organizations of stockholders (usually merchants and wealthy landowners) who sought personal economic gain and, perhaps, wanted also to advance England's national goals. While the private sector financed the companies, the King provided each project with a charter or grant conferring economic rights as well as political and judicial authority. The colonies generally did not show quick profits, however, and the English investors often turned over their colonial charters to the settlers. The political implications, although not realized at the time, were enormous. The colonists were left to build their own lives, their own communities, and their own economy.

What early colonial prosperity there was resulted from trapping and trading in furs. But throughout the colonies, people lived primarily on small farms and were self-sufficient. In the few small cities and among the larger plantations of South Carolina, and Virginia, some necessities and virtually all luxuries were imported in return for tobacco, rice, and indigo (blue dye) exports.

Supportive industries developed as the colonies grew. A variety of specialized sawmills and gristmills appeared. Colonists established shipyards to build fishing fleets and, in time, trading vessels. They also built small iron forges. By the 18th century, regional patterns of development had become clear: the New England colonies relied on ship-building and sailing to generate wealth; plantations (many using slave labor) in Maryland, Virginia, and the Carolinas grew tobacco, rice, and indigo; and the middle colonies of New York, Pennsylvania, New Jersey, and Delaware shipped general crops and furs. Except for slaves, standards of living were generally high--higher, in fact, than in England itself. Because English investors had withdrawn, the field was open to entrepreneurs among the colonists.

By 1770, the North American colonies were ready, both economically and politically, to become part of the emerging self-government movement that had dominated English politics since the time of James I (1603-1625). Disputes developed with England over taxation and other matters; Americans hoped for a modification of English taxes and regulations that would satisfy their demand for more self-government. Few thought the mounting quarrel with the English government would lead to all-out war against the British and to independence for the colonies.

Like the English political turmoil of the 17th and 18th centuries, the American Revolution (1775-1783) was both political and economic, bolstered by an emerging middle class with a rallying cry of "unalienable rights to life, liberty, and property" -- a phrase openly borrowed from English philosopher John Locke's Second Treatise on Civil Government (1690). While political separation from England may not have been the majority of colonists' original goal, independence and the creation of a new nation -- the United States -- was the ultimate result. It was a prosperous time.

New nation

The U.S. Constitution, adopted in 1789, established that the entire nation -- stretching then from Maine to Georgia, from the Atlantic Ocean to the Mississippi Valley -- was a unified, or common market. There were to be no internal tariffs or taxes on interstate commerce. The extent of federal power was much debated, with Alexander Hamilton taking a very broad view as the first secretary of the treasury. He succeeded in building a strong national credit based on a national debt held by rich people (who would then have an interest in keeping the government in healthy condition), and funded by tariffs on imported goods. Hamilton believed the United States should pursue economic growth through diversified shipping, manufacturing, and banking. He proposed measures like protective tariff to pay the costs of government, along with a tax on whiskey that western farmers strongly resented. He sought and achieved Congressional authority to create the First Bank of the United States in 1791, which lasted until 1811.

Thomas Jefferson and James Madison opposed a strong central government but they could not stop Hamilton. Jeffersonians closed the national bank in 1811, but reversed themselves and created the Second Bank of the United States in 1816. Thomas Jefferson based his philosophy on protecting the common man from political and economic tyranny. He particularly praised small farmers as "the most valuable citizens." In 1801, Jefferson became president and turned to promoting a more decentralized, agrarian democracy called Jeffersonian democracy.

Textiles in New England

The United States followed the British lead in building a cotton and woolen textile industry. The first factories were built using stolen blueprints and illegally immigrating engineers. Samuel Slater (1768-1835) of Rhode Island pulled American cotton-spinning technology by constructing carding, drawing, and roving machinery, and by determining the operating and gearing ratios necessary to use water power. By 1850 the American had built their own industrial revolutions around textiles, and use of abundant water power in New England.

Rural growth

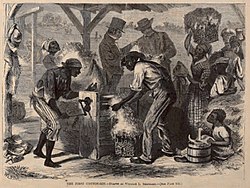

Cotton, at first a small-scale crop in the South, boomed following Eli Whitney's invention in 1793 of the cotton gin, a machine that separated raw cotton from seeds and other waste. Large plantations were the most efficient operations; they were run by rich owners with a few white overseers, and scores or hundreds of African American slaves.

Millions moved to the more fertile farmland of the Midwest. Government-created national roads and waterways, such as the Cumberland Pike (1818) and the Erie Canal (1825), helped new settlers migrate west and helped move western farm produce to market. The Whig Party supported Clay's American System, which proposed to build internal improvements (roads, canals, harbors) protect industry, and create a strong national bank. The Whig legislation program was blocked by the Democrats, however.

President Andrew Jackson (1829-1837) opposed the Second National Bank, which he believed favored the entrenched interests of his enemies. When he was elected for a second term, Jackson opposed renewing the bank's charter, and Congress supported him. Jackson opposed paper money and demanded the government be paid in gold and silver coins. The Panic of 1837 stopped business growth for three years.

Railroads were a critical factor in the economy after 1850. Shipping costs and time fell, opening up a vast internal market. The declining cost of shipping bulk products made large-scale farming possible for grains and meat. Passenger traffic made movement easy. The associated telegraph and postal systems gave a fast information system. Hundreds of factories and repair shops created a class of mechanics. Bridgework and new lines created a large construction industry. Financial paper, especially corporate bonds, made Wall Street possible. The railroads invented new corporate stuctures, and invented the careeer path. They hired young men and promoted internally, using a well-defined set of rules and criteria that created the modern bureaucracy.

Panics did not curtail rapid U.S. economic growth during the 19th century. Long term demographic growth, expansion into new farmlands, and creation of new factories continued. New inventions and capital investment led to the creation of new industries and economic growth. As transportation improved, new markets continuously opened. The steamboat made river traffic faster and cheaper, but development of railroads had an even greater effect, opening up vast stretches of new territory for development. Like canals and roads, railroads received large amounts of government assistance in their early building years in the form of land grants. But unlike other forms of transportation, railroads also attracted a good deal of domestic and European private investment.

| Table 1: RAILROAD MILEAGE INCREASE BY GROUPS OF STATES | |||||

| 1850 | 1860 | 1870 | 1880 | 1890 | |

| New England | 2,507 | 3,660 | 4,494 | 5,982 | 6,831 |

| Middle States | 3,202 | 6,705 | 10,964 | 15,872 | 21,536 |

| Southern States | 2,036 | 8,838 | 11,192 | 14,778 | 29,209 |

| Western States and Territories | 1,276 | 11,400 | 24,587 | 52,589 | 62,394 |

| Pacific States and Territories | 23 | 1,677 | 4,080 | 9,804 | |

| TOTAL USA | 9,021 | 30,626 | 52,914 | 93,301 | 129,774 |

| SOURCE: Chauncey M. Depew (ed.), One Hundred Years of American Commerce 1795-1895 p 111 | |||||

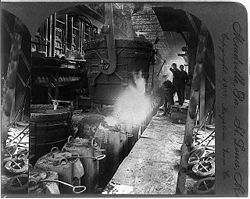

Early industrialization

The Industrial Revolution began in Europe in the late 18th and early 19th centuries, and it quickly spread to the United States. By 1860, when Abraham Lincoln was elected president and brought a pro-business attitude to the national government, 16% of the population lived in urban areas, and a third of the nation's income came from manufacturing. Urbanized industry was limited primarily to the Northeast; cotton cloth production was the leading industry, with the manufacture of shoes, woolen clothing, and machinery also expanding. Many new workers were immigrants. Between 1845 and 1855, some 300,000 European immigrants arrived annually. Most were poor and remained in eastern cities, often at ports of arrival.

The South, on the other hand, remained rural and dependent on the North for capital and manufactured goods. Southern economic interests, including slavery, could be protected by political power only as long as the South controlled the federal government. The Republican Party, organized in 1856, represented the industrialized North. In 1860, Republicans and their presidential candidate, Abraham Lincoln were speaking hesitantly on slavery, but they were much clearer on economic policy. In 1861, they successfully pushed adoption of a protective tariff. In 1862, the first Pacific railroad was chartered. In 1863 a national banking system was established to finance the American Civil War; in every city a "First National Bank" was established, and many still exist.

Civil War and Reconstruction: 1860s

The industrial advantages of the North over the South guaranteed victory in a long-term war that depended less on battles and more on supplies. The slave-labor system was abolished, making the large southern cotton plantations much less profitable. Northern industry, which had expanded rapidly before and during the war, surged ahead. Industrialists came to dominate many aspects of the nation's life, including social and political affairs. The planter aristocracy of the South disappeared.

The devastation of the South was great and poverty ensued. During Reconstruction railroad construction was heavily subsidized (with much corruption), but the region maintained its dependence on cotton. Former slaves became wage laborers on farms, tenant farmers, or sharecroppers. They were joined by many poor whites, as the population grew faster than the economy. As late as 1940 the only significant manufacturing industries in the South were textile mills in the Carolinas, and some steel in Alabama.

The Gilded Age: 1870s-1890s

The rapid economic development following the Civil War laid the groundwork for the modern U.S. industrial economy. Oil was discovered in western Pennsylvania, making kerosene a cheaper substitute for whale oil in lighting. Office tools like the typewriter was developed. Refrigeration railroad cars came into use to move meat and fruit long distances--even from California. Electric lights cand strret cars came to the cities and, around 1900, the first automobiles (based on European ideas) started to appear.

Parallel to these achievements was the development of the nation's industrial infrastructure. Coal was found in abundance in the Appalachian region from Pennsylvania south to Kentucky and west to Ohio and Illinois. Large iron mines opened in the Lake Superior region of the upper Midwest. Steel mills thrived in places where these two important raw materials could be brought together to produce steel. Large copper and silver mines opened, followed by lead mines and cement factories.

As industry grew larger, it developed mass-production methods. Frederick W. Taylor pioneered the field of scientific management in the late 19th century, carefully plotting the functions of various workers and then devising new, more efficient ways for them to do their jobs. Also fueling mass production was the increase in efficiency due to the electrification of factories from steam power to electric power. Electric line shafts and electric group drives improved efficiency through reduced energy loss, improved work environment, reduction in fire hazards and ability to reorgazine factories into specialized departments. (True mass production was the inspiration of Henry Ford, who in 1913 adopted the moving assembly line, with each worker doing one simple task in the production of automobiles. In what turned out to be a farsighted action, Ford offered a very generous wage -- $5 a day -- to his workers, enabling many of them to buy the automobiles they made, helping the industry to expand.)

The "Gilded Age" of the second half of the 19th century was the epoch of tycoons. Many Americans came to idealize these businessmen who amassed vast financial empires. Often their success lay in seeing the long-range potential for a new service or product, as John D. Rockefeller did with oil. They were fierce competitors, single-minded in their pursuit of financial success and power. Other giants in addition to Rockefeller and Ford included Jay Gould, who made his money in railroads; J. Pierpont Morgan, banking; and Andrew Carnegie, steel. Some tycoons were honest according to business standards of their day; others, however, used force, bribery, and guile to achieve their wealth and power. For better or worse, business interests acquired significant influence over government.

Morgan, perhaps the most flamboyant of the entrepreneurs, operated on a grand scale in both his private and business life. He and his companions gambled, sailed yachts, gave lavish parties, built palatial homes, and bought European art treasures. In contrast, men such as Rockefeller and Ford exhibited puritanical qualities. They retained small-town values and lifestyles. As church-goers, they felt a sense of responsibility to others. They believed that personal virtues could bring success; theirs was the gospel of work and thrift. Later their heirs would establish the largest philanthropic foundations in America.

While upper-class European intellectuals generally looked on commerce with disdain, most Americans -- living in a society with a more fluid class structure -- enthusiastically embraced the idea of moneymaking. They enjoyed the risk and excitement of business enterprise, as well as the higher living standards and potential rewards of power and acclaim that business success brought.

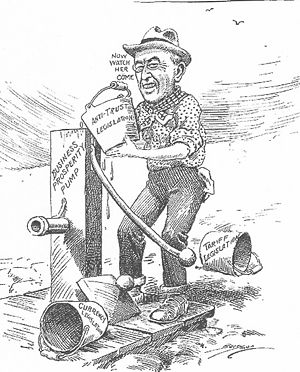

Progressive Era: 1890-1920

In the early years of American history, most political leaders were reluctant to involve the federal government too heavily in the private sector, except in the area of transportation. In general, they accepted the concept of laissez-faire, a doctrine opposing government interference in the economy except to maintain law and order. This attitude started to change during the latter part of the 19th century, when small business, farm, and labor movements began asking the government to intercede on their behalf.

The American labor movement began with the first significant labor union, the Knights of Labor in 1867. The group helped begin the movement to end child labor, have an eight-hour workday, and use collective bargaining to help improve workers' lots.

A popular movement formed in the agricultural sector at the same time. The Grange movement, also founded in 1867, was a group of farmers who banded together to fight railroad monopolies that hurt grain shipping and to protect other farming interests.

By the turn of the century, a middle class had developed that was leery of both the business elite and the somewhat radical political movements of farmers and laborers in the Midwest and West. Known as Progressives, these people favored government regulation of business practices to ensure competition and free enterprise. They also fought corruption in the public sector.

Congress enacted a law regulating railroads in 1887 (the Interstate Commerce Act), and one preventing large firms from controlling a single industry in 1890 (the Sherman Antitrust Act). These laws were not rigorously enforced, however, until the years between 1900 and 1920, when Republican President Theodore Roosevelt (1901-1909), Democratic President Woodrow Wilson (1913-1921), and others sympathetic to the views of the Progressives came to power. Many of today's U.S. regulatory agencies were created during these years, including the Interstate Commerce Commission and the Federal Trade Commission.

Muckrakers also had a big impact on increasing regulation of American business. Upton Sinclair's The Jungle (1906) showed America what life was like in the Chicago Union Stock Yards, a giant complex of meat processing that developed in the 1870s. The federal government responded to Sinclair's book with the new regulatory Food and Drug Administration. Ida M. Tarbell wrote a series of articles against the Standard Oil monopoly. The series helped pave the way for the breakup of the monopoly.

When Democrat Woodrow Wilson was elected President with a Democratic Congress in 1912 he implemented a series of progressive policies. In 1913, the Sixteenth Amendment was ratified, and the income tax was instituted in the United States. While public spending as a percent of GDP had declined during the Taft AdministrationTemplate:Fact, it began to rise under Wilson's leadership in a trend that would continue for many decades. Wilson created the Federal Reserve, a complex business-government partnership that created the first central bank since 1836. The departure of working men to serve in the armed forces was a significant blow to the workforce, and many women gained employment during the war.

Roaring Twenties: 1920-1929

Under Republican President Warren G. Harding, who called for normalcy and an end to high wartime taxes, Secretary of the Treasury Andrew Mellon raised the tariff, cut other taxes, and used the large surplus to reduce the federal debt by about a third from 1920 to 1930. Secretary of Commerce Herbert Hoover worked to introduce efficiency, by regulating business practices. This period of prosperity, along with the culture of the time, was known as the Roaring Twenties. The rapid growth of the automobile industry stimulated industries such as oil, glass, and road-building. Tourism soared and consumers with cars had a much wider radius for their shopping. Small cities prospered, and large cities had their best decade ever, with a boom in construction of offices, factories and homes. The new electric power industry transformed both business and everyday life. Telephones and electricity spread to the countryside, but farmers never recovered from the wartime bubble in land prices. Millions migrated to nearby cities. However, in October 1929, the stock market crashed and banks began to fail in the Wall Street Crash of 1929.

Great Depression: 1929-1941

The Federal Reserve Board chose to stand by, leaving interest rates high and not shoring up banks, while Congress expanded government in an effort to alleviate the recession. There was a sharp drop in the money supply, which would amount to a one-third reduction by 1933. President Herbert Hoover passed a massive tax increase to boost sagging federal revenues, and signed the protectionist Smoot-Hawley Tariff, which incited retaliation by Canada, Britain, Germany and other trading partners. The U.S. economy plunged into depression. By 1932, the unemployment rate was 23.6%. Conditions were worse in heavy industry, lumbering, export agriculture (cotton, wheat, tobacco), and mining. Conditions were not quite as bad in white collar sectors and in light manufacturing.

Franklin Delano Roosevelt was elected President in 1932 without a specific program. He relied on a highly eclectic group of advisors who patched together many programs, known as the New Deal.

Government spending increased from 8.0% of GNP under Hoover in 1932 to 10.2% of GNP in 1936. While Roosevelt balanced the "regular" budget the emergency budget was funded by debt, which increased from 33.6% of GNP in 1932 to 40.9% in 1936. [Historical Statistics (1976) series Y457, Y493, F32] Deficit spending had been recommended by some economists, most notably John Maynard Keynes in Britain. Roosevelt met Keynes but did not pay attention to his recommendations. After a meeting with Keynes, who kept drawing diagrams, Roosevelt remarked that "He must be a mathematician rather than a political economist."

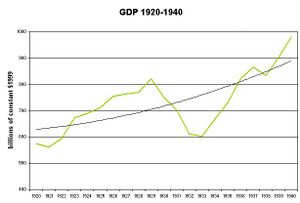

The extent to which the spending for relief and public works provided a sufficient stimulus to revive the U.S. economy, or whether it harmed the economy, is also debated. If one defines economic health entirely by the gross domestic product, the U.S. had gotten back on track by 1934, and made a full recovery by 1936, but as Roosevelt said, one third of the nation was ill fed, ill-housed and ill-clothed. See Chart 3. GNP was 34% higher in 1936 than 1932, and 58% higher in 1940 on the eve of war. The economy grew 58% from 1932 to 1940 in 8 years of peacetime, and then grew 56% from 1940 to 1945 in 5 years of wartime. However, the unemployment rate never went below 9% before the draft. During the war the economy operated under so many different conditions that comparison is impossible with peacetime, such as massive spending, price controls, bond campaigns, controls over raw materials, prohibitions on new housing and new automobiles, rationing, guaranteed cost-plus profits, subsidized wages, and the draft of 12 million soldiers.

As Broadus Mitchell summarized, "Most indexes worsened until the summer of 1932, which may be called the low point of the depression economically and psychologically." (Mitchell p 404) Economic indicators show the American economy reached nadir in summer 1932 to February 1933, then began a steady, sharp upward recovery that persisted until 1937. Thus the Federal Reserve Index of Industrial Production hit its low of 52.8 on July 1, 1932 and was practically unchanged at 54.3 on March 1, 1933; however by July 1, 1933, it reached 85.5 (with 1935-39 = 100, and for comparison 2005 = 1,342).[3]

| Table 2: Depression Data[2] | 1929 | 1931 | 1933 | 1937 | 1938 | 1940 |

|---|---|---|---|---|---|---|

| Real Gross National Product (GNP) 1 | 101.4 | 84.3 | 68.3 | 103.9 | 103.7 | 113.0 |

| Consumer Price Index 2 | 122.5 | 108.7 | 92.4 | 102.7 | 99.4 | 100.2 |

| Index of Industrial Production 2 | 109 | 75 | 69 | 112 | 89 | 126 |

| Money Supply M2 ($ billions) | 46.6 | 42.7 | 32.2 | 45.7 | 49.3 | 55.2 |

| Exports ($ billions) | 5.24 | 2.42 | 1.67 | 3.35 | 3.18 | 4.02 |

| Unemployment (% of civilian work force) | 3.1 | 16.1 | 25.2 | 13.8 | 16.5 | 13.9 |

1 in 1929 dollars

2 1935-39 = 100

Wartime Controls: 1941-1945

The War Production Board coordinated the nation's productive capabilities so that military priorities would be met. Converted consumer-products plants filled many military orders. Automakers built tanks and aircraft, for example, making the United States the "arsenal of democracy." In an effort to prevent rising national income and scarce consumer products to cause inflation, the newly created Office of Price Administration controlled rents on some dwellings, rationed consumer items ranging from sugar to gasoline, and otherwise tried to restrain price increases.

By the early 1940s, the United States had managed to pull itself strongly out of the Depression, largely due to World War II, but there is an ongoing, politically charged debate on whether Franklin Roosevelt's social-democratic policies had anything to do with this, and some argue that Roosevelt's policies hampered recovery, or even made the problem worse than it would have been. Recovery was also, in part, at least, due to the natural resilience of the economy; the Great Depression was the sixth depression in U.S. history. Wall Street enjoyed the longest bull run in history in this post-war period, as the stock market climbed almost uninterrupted from 1949 to 1957. The U.S. government involvement in social welfare and what Dwight Eisenhower called the "military-industrial complex" continues to this day.

Six million women took jobs in manufacturing and production; most were newly created temporary jobs in munitions. Some were replacing men away in the military. These working woman were symbolized by the fictional character of Rosie the Riveter. After the war, many women returned to household as men returned, but the use of women workers in World War II paved the way for later integration of women into the American workforce.

Postwar Prosperity: 1945-1973

The end of World War II to the late 1960s was a golden era of American capitalism.

The Council of Economic Advisors was established by the Employment Act of 1946 to provide objective economic analysis and advice on the development and implementation of a wide range of domestic and international economic policy issues. In its first 7 years the CEA made five technical advances in policy making: 1) the replacement of a "cyclical model" of the economy by a "growth model," 2) the setting of quantitative targets for the economy, 3) use of the theories of fiscal drag and full-employment budget, 4) recognition of the need for greater flexibility in taxation, and 5) replacement of the notion of unemployment as a structural problem by a realization of a low aggregate demand. In 1949 a dispute broke out between chairman Edwin Nourse and member Leon Keyserling. Nourse believed a choice had to be made between "guns or butter" but Keyserling argued that an expanding economy permitted large defense expenditures without sacrificing an increased standard of living. In 1949 Keyserling gained support from powerful Truman advisors Dean Acheson and Clark Clifford. Nourse resigned as chairman, warning about the dangers of budget deficits and increased funding of "wasteful" defense costs. Keyserling succeeded to the chairmanship and influenced Truman's Fair Deal proposals and the economic sections of National Security Council Resolution 68 that, in April 1950, asserted that the larger armed forces America needed would not affect living standards or risk the "transformation of the free character of our economy."

During the 1953-54 recession, the CEA, headed by Arthur Burns deployed traditional Republican rhetoric. However it supported an activist contracyclical approach that helped to establish Keynesianism as a bipartisan economic policy for the nation. Especially important in formulating the CEA response to the recession - accelerating public works programs, easing credit, and reducing taxes - were Arthur F. Burns and Neil H. Jacoby.

President Kennedy passed the largest tax cut in history upon entering office in 1961. $200,000,000,000 in war bonds matured, and the G.I. Bill financed a well-educated work force. The middle class swelled, as did GDP and productivity. The U.S. underwent a kind of golden age of economic growth. This growth was distributed fairly evenly across the economic classes, which some attribute to the strength of labor unions in this period - labor union membership peaked historically in the U.S. during the 1950s, in the midst of this massive economic growth. Lyndon B. Johnson (1963-69) dreamed of creating a "Great Society", and began many new social programs to that end, such as Medicaid and Medicare. The government financed some of private industry's research and development throughout these decades, most notably ARPANET (which would become the Internet) in the late 1960s. In 1968 and 1969, productivity growth climbed near the levels it had reached earlier in the decade, but this would not last.

Inflation woes: 1970s

In the late 1960s it was apparent to some that this juggernaut of economic growth was slowing down, and it began to become visibly apparent in the early 1970s. Stagflation gripped the nation, and the government experimented with wage and price controls under President Nixon. The Bretton Woods Agreement collapsed in 1971-1972, and President Nixon closed the gold window at the Federal Reserve, taking the United States entirely off the gold standard. President Gerald Ford introduced the slogan, "Whip Inflation Now" (WIN). In 1974, productivity shrunk by 1.5%, though this soon recovered. In 1976, Jimmy Carter won the Presidency. Carter would later take much of the blame for the even more turbulent economic times to come, though some say circumstances were outside his control. Inflation continued to climb skyward. Productivity growth was pitiful, when not negative. Interest rates remained high, with the prime reaching 20% in January 1981; Art Buchwald quipped that 1980 would go down in history as the year when it was cheaper to borrow money from the Mafia than the local bank.The downside of borrowing from the mafia was that if money was not repayed usually your life was taken.

Unemployment dropped mostly steadily from 1975 to 1979, although it then began to rise sharply.

This period also saw the increased rise of the environmental and consumer movements, and the government established new regulations and regulatory agencies such as the Occupational Safety and Health Administration, the Consumer Product Safety Commission, the Nuclear Regulatory Commission, and others.

Deregulation: 1974-1992

The deregulation movement began when Nixon left office and was a bipartisan operation under Ford, Carter and Reagan. Most important were the removals of New Deal regulations from energy, communications, transportation and banking. The hasty removal of regulation of Savings and Loans while keeping federal insurance led to the Savings and Loan crisis which cost the government an estimated $160 billion.

In 1981, Ronald Reagan introduced fiscally-expansive economic policies, cutting marginal federal income tax rates by 25%. Inflation dropped dramatically from 13.5% annually in 1980 to just 3% annually in 1983 due to a short recession and the Federal Reserve Chairman Paul Volker's tighter control of the money supply and interest rates. Real GDP began to grow after contracting in 1980 and 1982. The unemployment rate continued to rise to a peak of 10.8% by late 1982, but then dropped as sharply as it had risen to a level of 5.4% at the end of Reagan's presidency in January 1989. Critics of the Reagan Administration often point to the fact that the gap between those in the upper socioeconomic levels and those in the lower socioeconomic levels increased during Reagan's presidency; they also note that the federal debt spawned by his policies tripled (from $930 billion on December 31, 1981 to $2.6 trillion on September 30, 1988), reaching record levels. Every president in the later half of the 20th century before Reagan reduced debt as a share of GDP. In addition to the fiscal deficits, the U.S. started to have large trade deficits. Also it was during his second term that the Tax Reform Act of 1986 was passed. In 1987, the stock market lost 22% of its value on Black Monday, although it is debated over how much (if any) of Reagan's policies had an effect on this. Vice President George H. W. Bush was elected to succeed Reagan as Commander-In-Chief in 1988. The early Bush Presidency's economic policies were essentially a continuation of Reagan's policies, but in the early 1990s, Bush went back on a promise and increased taxes in a compromise with Congressional Democrats. He ended his presidency on a moderate note, signing regulatory bills such as the Americans With Disabilities Act, a mandate stating that toilets use low amounts of water, and negotiating the North American Free Trade Agreement. In 1992, Bush and third-party candidate Ross Perot lost to Democrat Bill Clinton.

Inequality

The advent of deindustrialization in the late 1960s and early 1970s saw income inequality increase dramatically to levels typical of the pre-1940s (that is pre [[New Deal] era). In 1968, the U.S.' Gini coefficient was 0.386, about equivalent to that of contemporary Japan (.381), though still above that of the United Kingdom (.368) and Canada (.331). However, in the years since deregulation and globalization have allowed U.S. companies to begin to shift their manufacturing and heavy industrial operations to second- and third-world countries with lower labor costs, income inequality in the U.S. has risen dramatically. In 2005, the American Gini coefficient had reached 0.469silimar to that of China (.440). Critics of economic policies favored by Republican and Democratic administrations since the 1960s, particularly those expanding "free trade" and "open markets" say that these policies, though benefiting other nations as well as the cost of products in the U.S., have taken their own heavy toll on the prosperity of the American working class.

Prosperity: 1990s

During the 1990s, the national debt increased by 75%, GDP rose by 69%, and the stock market as measured by the S&P 500 grew more than three-fold.

Over his term, Clinton would introduce welfare reform, while with Republicans in control of Congress, most major spending programs were opposed and government spending increases stayed relatively low.Template:Fact

From 1994 to 2000 real output increased, inflation was manageable and unemployment dropped to below 5%, resulting in a soaring stock market known as the Dot-com bubble. The second half of the 1990s was characterized by well-publicized Initial Public Offerings of High-tech and "dotcom" companies. By 2000, however, it was evident a bubble in stock valuations had occurred, such that beginning in March 2000, the market would give back some 50% to 75% of the growth of the 1990s. The economy worsened in 2001 with output increasing only 0.3% and unemployment and business failures rising substantially, and triggering a recession that is often blamed on the September 11, 2001 Terrorist Attacks.

Bibliography

- Atack, Jeremy and Peter Passell. A New Economic View of American History: From Colonial Times to 1940 (1994) online, 1st edition was Lee, Susan Previant, and Peter Passell. A New Economic View of American History (1979)

- Chandler, Alfred D. and James W. Cortada. A Nation Transformed by Information: How Information Has Shaped the United States from Colonial Times to the Present (2000) online

- Cochran; Thomas C. 200 Years of American Business. (1977) online

- Cochrane, Willard W. The Development of American Agriculture: A Historical Analysis (1993)

- Engerman, Stanley L. and Robert E. Gallman, eds. The Cambridge Economic History of the United States (2000), covers 1790-1914; heavily quantitative

- Gordon, John Steele An Empire of Wealth: The Epic History of American Economic Power (2004), popular history

- Gordon, Robert. "U.S. Economic Growth since 1870: One Big Wave," American Economic Review 89:2 (May 1999), 123-28; in JSTOR

- Hurt, R. Douglas. American Agriculture: A Brief History (2002)

- Hughes, Jonathan and Louis P. Cain. American Economic History (6th Edition) (2002), textbook

- Kirkland; Edward C. A History of American Economic Life (1951), textbook online

- Schlebecker John T. Whereby we thrive: A history of American farming, 1607-1972 (1972)

- Studenski, Paul, and Herman Krooss. A Financial History of the United States (1952)

- Walton, Gary M. and Hugh Rockoff. History of the American Economy with Economic Applications (2004), textbook

- Whaples, Robert and Dianne C. Betts, eds. Historical Perspectives on the American Economy: Selected Readings (1995) articles

Colonial

- Bidwell, Percy and Falconer, John I. History of Agriculture in the Northern United States 1620-1860 (1941)

- McCusker, John J. ed. Economy of British America, 1607-1789 (1991), 540pp

- McGaw Judith A. (ed.) Early American Technology: Making and Doing Things From the Colonial Era to 1850 (1994)

- Weeden, William Babcock. Economic and Social History of New England, 1620-1789 (1891) 964 pages; online edition

1775-1860

- Batchelder, Samuel. Introduction and Early Progress of the Cotton Manufacture in the United States (1863) online edition

- Bidwell, Percy and Falconer, John I. History of Agriculture in the Northern United States 1620-1860 (1941)

- Chandler, Alfred. "Anthracite Coal and the Beginnings of the ‘Industrial Revolution' in the United States," Business History Review 46 (1972): 141-181.

- Clark, Victor S. History of Manufactures in the United States: 1607-1860 (1916) online at books.google.com

- Cohen, Isaac. American Management and British Labor: A Comparative Study of the Cotton Spinning Industry (1990) online edition

- Cole, Arthur Harrison. The American Wool Manufacture 1926

- Copeland, Melvin Thomas. The Cotton Manufacturing Industry of the United States (1912) online edition

- Genovese, Eugene. Roll, Jordan Roll (1967), highly influential history of plantation slavery

- Gray, Lewis Cecil. History of Agriculture in the Southern United States to 1860. 2 vol (1933), classic in-depth history online edition

- Licht, Walter. Industrializing America: The Nineteenth Century (1995) survey

- Mathias, Peter, and M. M. Postan, eds. The Cambridge Economic History of Europe from the Decline of the Roman Empire, Vol. 7, Pt. 2 The Industrial Economies: Capital, Labour and Enterprise, The United States, Japan and Russia, (1978)

- Meyer, David R. The Roots of American Industrialization (2002)

- Nettels, Curtis P. The Emergence of a National Economy, 1775-1815 (1962) broad economic history of the era

- Olson, James S. Encyclopedia of the Industrial Revolution in America (2001)

- Phillips, Ulrich B. "The Decadence of the Plantation System." Annals of the American Academy of Political and Social Sciences, 35 (January, 1910): 37-41. in JSTOR

- Ransom, Roger. Conflict and Compromise: The Political Economy of Slavery, Emancipation and the American Civil War (1989)

- Sellers, Charles, The Market Revolution: Jacksonian America, 1815-1846 (1994) online

- Taylor, George Rogers. The Transportation Revolution, 1815-1860 (1951)

- Temin, Peter. Iron and Steel in Nineteenth-Century America, An Economic Inquiry (1964)

- Temin, Peter. The Jacksonian Economy (1969) online

- Wright, Gavin. Old South, New South: Revolutions in the Southern Economy since the Civil War (1986)

- Wright, Gavin. The Political Economy of the Cotton South: Households, Markets, and Wealth in the Nineteenth Century (1978) online

- Wright, Robert E. and David J. Cowen. Financial Founding Fathers: The Men Who Made America Rich, University of Chicago Press, 2006. ISBN 0-226-91068-7.

1860-1914

- Adams, Sean Patrick. "The US Coal Industry in the Nineteenth Century."] EH.Net Encyclopedia, August 15 2001 scholarly overview online edition

- Cyclopedia of American agriculture; a popular survey of agricultural conditions, ed by L. H. Bailey, 4 vol 1907-1909. online edition highly useful compendium

- Cannadine, David. Mellon: An American Life (2006)

- Chandler, Alfred, ed. The Railroads: The Nation's First Big Business - Sources and Readings. (1965)

- Chandler, Alfred D. The Visible Hand: The Managerial Revolution in American Business (1977), highly influential interpretation of history of big business

- Chandler, Alfred D.; Strategy and Structure: Chapters in the History of the Industrial Enterprise (1969)complete text online; excerpt and text search

- Fite, Gilbert C. The Farmers' Frontier: 1865-1900 (1966), the west

- Hogan, William T. Economic History of the Iron and Steel Industry in the United States. (1971) 5 vol.

- Krass, Peter. Carnegie (2002). online edition ISBN 0-471-38630-8.

- Jenks, Leland H. "Railroads as an Economic Force in American Development," The Journal of Economic History, Vol. 4, No. 1 (May, 1944), 1-20. in JSTOR

- Kirkland, Edward Chase. Men, Cities and Transportation, A Study of New England History 1820-1900 2 vol (1948)

- Klein, Maury. The Life & Legend of E. H. Harriman (2000) online edition

- Licht, Walter. Industrializing America: The Nineteenth Century (1995) survey* Misa, Thomas J. A Nation of Steel: The Making of Modern America, 1865-1925 (1998)

- Nasaw, David. Andrew Carnegie (2006), the standard biography excerpt and text search

- Netschert, Bruce C. and Sam H. Schurr, Energy in the American Economy, 1850-1975: An Economic Study of Its History and Prospects. (1960) online

- Martin, Albro. Railroads Triumphant: The Growth, Rejection, and Rebirth of a Vital American Force (1992) excerpt and text search

- Middleton, William D. ed. Encyclopedia of North American Railroads (2007) Indiana U. Press: 1200 pp; the most valuable reference book; 500+ entries by experts, with bibliographies

- Moody, John. The Railroad Builders: A Chronicle of the Welding of the States (1919) online at Project Gutenberg

- Raper, Charles Lee. and Arthur Twining Hadley. Railway Transportation: A History of Its Economics and of Its Relation to the State, (1912) 331 pages; online at Google

- Riegel, Robert Edgar. The Story of the Western Railroads 1926 onine edition

- Stover, John. American Railways (2nd ed 1997) good, brief overview; excerpt online at Amazon.com

- Warren, Kenneth. Triumphant Capitalism: Henry Clay Frick and the Industrial Transformation of America. U. of Pittsburgh Press, 1996.

- Warren, Kenneth. Big Steel: The First Century of the United States Steel Corporation, 1901-2001. (University of Pittsburgh Press, 2001) online review

- Whaples, Robert. "Andrew Carnegie", EH.Net Encyclopedia of Economic and Business History.

1914-1970

- Devine, Warren D. Jr. "From Shafts to Wire: Historical Perspective on Electrification". Journal of Economic History, Vol 43, No. 2 (June 1983) pp. 347-372.

- Hogan, William T. Economic History of the Iron and Steel Industry in the United States. (1971) 5 vol.

- Mitchell, Broadus. The Depression Decade: From New Era through New Deal, 1929-1941 (1947) broad economic history of the era; online

- Netschert, Bruce C. and Sam H. Schurr, Energy in the American Economy, 1850-1975: An Economic Study of Its History and Prospects. (1960) online

- Soule, George. The Prosperity Decade: From War to Depression, 1917-1929 (1947) broad economic history of decade

- Warren, Kenneth. Big Steel: The First Century of the United States Steel Corporation, 1901-2001. (University of Pittsburgh Press, 2001) online review

1970- Present

- French, Michael. US Economic History since 1945 (1997)

- Goldin, Claudia Understanding the Gender Gap: An Economic History of American Women (1990), quantitative

- Stiglitz, Joseph E. The Roaring Nineties: A New History of the World's Most Prosperous Decade (2004) excerpt and text search

- Stiglitz, Joseph E. Making Globalization Work (2007) excerpt and text search

Data and primary sources

- Carter, Susan B., Scott Sigmund Gartner, Michael R. Haines, and Alan L. Olmstead, eds. The Historical Statistics of the United States (Cambridge University Press: 6 vol 2006); online (in Excel format) at some universities. 37,000 data sets make it the standard data source for all topics

- Phillips, Ulrich B. ed. Plantation and Frontier Documents, 1649-1863; Illustrative of Industrial History in the Colonial and Antebellum South: Collected from MSS. and Other Rare Sources. 2 Volumes. (1909). online vol 1 and online vol 2

- Schmidt, Louis Bernard. ed. Readings in the economic history of American agriculture (1925) online edition

- Bureau of Economic Analysis: Official United States GDP data

- US GDP 1790 to 2005, include GDP, Real GDP, population, GDP per capita, and Real GDP per capita